/6d64fdd4-ef77-4d90-9d64-bcaa3fa3e6ea_1.png)

KYC Analyst Job Description

Review Rating Score

An effective job description is vital when finding suitable job candidates. No need to start from scratch. By making use of this sample job description template you will make it easier for yourself and you will have a head start.

How do I write a KYC Analyst Job Description?

This sample Job description explainer offers guidance on key sections that are important to include for clarity, as well as suggestions for promoting the position. It provides a list of duties, responsibilities, tasks, requirements, demands for setting job expectations and the employee's ability to perform the work as described. However, it’s often not construed as an exhaustive list of all functions, responsibilities, skills and abilities. When writing a job description, consider the following:

- Highlight the accurate job title;

- Provide a general company introduction;

- Provide a brief summary or introduction that provides an overview of the job;

- Specify the relevant job duties and responsibilities that are necessary for this position;

- List essential qualifications;

- Be clear and concise;

- Have someone proofread it;

- Make sure that HR and the hiring manager will sign off before publishing it;

- Define what success looks like in the position after 30 days, the first quarter, and the first year;

- Provide direct contact details of the manager or HR department who will follow up on the candidates.

Publish it via several social media platforms, or offline media, so you are sure that in-house employees also can get easy access to it.

What does KYC AML analyst do?

Responsibilities:

- Performing the due diligence on new Clients, requesting the KYC information, documentation, review and verification of received documentation and making an analytical risk assessment for new Clients.

- Thoroughly and succinctly document the research and analysis related to the financial activity and related entities of Clients, for an audience that includes Management, Regulators, Internal Audit, Senior Managers and Internal Compliance.

- Periodically evaluate existing Clients according to established policies and procedures.

- Periodical review of KYC records as to completeness, including verifying that due diligence has been performed and that CBC (due diligence) standards are complied with; also that the files and risk assessments are current and up to date.

- Investigating high risk clients and reporting where necessary, including Politically Exposed Persons, and obtaining all necessary documentation to complete the client file.

- Process entries to open/close clients’ account on our KYC / Related Parties and CDD database, and instruct Client Desk to open/close the accounts on account level in Equation where applicable.

- Maintain continuous contact with customer in order to keep customer file updated.

- Process amended client’ records on our KYC / RP and CDD database.

- Communicate effectively and efficiently with relevant internal and external parties to obtain KYC documents.

- Have a thorough understanding of client’s business and related parties in order to monitor client’s activities for unusual transactions.

- Perform further investigation on identified suspicious client and client’s transactions and report to KYC/AML compliance officer.

Qualifications:

- Must have a Bachelor degree in law or business administration or country equivalent in a related discipline together with equivalent working experience.

- 2-3 years of experience in similar position.

- Can demonstrate experience in KYC work within the financial service industry.

- Good understanding of AML and CTF framework.

- Hedge fund industry and/or Trust business experience is an advantage.

- Experience with AML monitoring and screening is an advantage.

- Compliance qualification is an advantage.

- Strong research and analytical skills.

- Excellent communication skills in English, both verbal and written.

- Must have good planning and time management/prioritization skills.

By using this KYC Analyst job description sample, modifying it to your needs, and then posting it, you will soon start receiving Resumes and Cover letter from suitable candidates. This KYC Analyst Job Description template is fully customizable and can be used in Google Docs, MS Word or Pages format. Get this printable file now and personalize it according to your needs.

Is the template content above helpful?

Thanks for letting us know!

Reviews

Florentino Chandler(12/15/2021) - USA

Please continue the Excellent work, we all benefit from document templates you provide.

Luci Jarvis(12/15/2021) - AUS

Perfect!!

Gladys Lynch(12/15/2021) - USA

I have received nice feedback from my friends

Vertie Manning(12/15/2021) - NZL

Thank you for this!!

Last modified

Our Latest Blog

- The Importance of Vehicle Inspections in Rent-to-Own Car Agreements

- Setting Up Your E-mail Marketing for Your Business: The Blueprint to Skyrocketing Engagement and Sales

- The Power of Document Templates: Enhancing Efficiency and Streamlining Workflows

- Writing a Great Resume: Tips from a Professional Resume Writer

Template Tags

Need help?

We are standing by to assist you. Please keep in mind we are not licensed attorneys and cannot address any legal related questions.

-

Chat

Online - Email

Send a message

You May Also Like

Treasurer Job Description for Foundation

Product Manager Real Estate Job Description

Restaurant Waiter Job Description | Manager | Customer Service | Serving Customers

Resort Nanny Job Description | Caring for Children, Cleaning, Assisting Parents

School Treasurer Job: Activities & Responsibilities

Pod Nanny Job Description: Experienced Nannies for Your Child's Education and Care

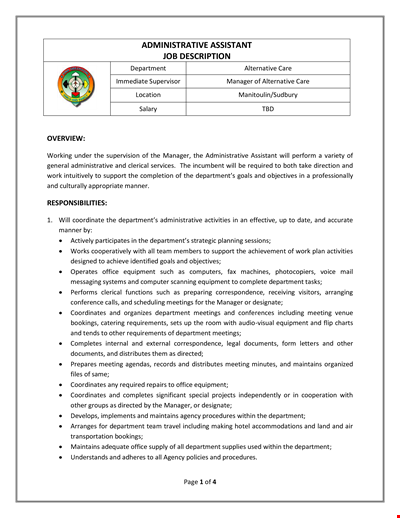

Administrative Job Description Template for Manager | Department | Agency | Administrative

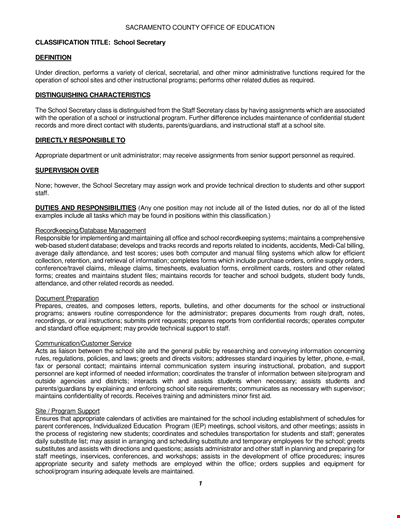

School Secretary Job Description: Office Staff & Personnel for Students

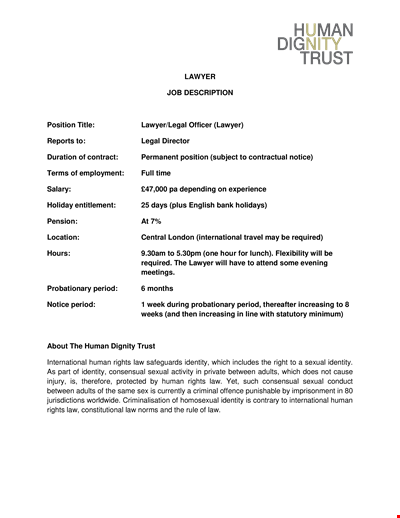

Legal Lawyer Job Description | Find Your Legal Career Here

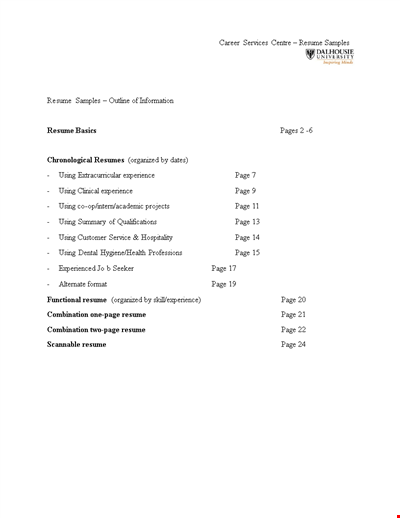

Free Download: HR First Job Resume Template | University, Experience, Skills, Relevant | Halifax

Dentist Operation Manager Job Description - Dental Program and Appropriate

Download Free General Sales Manager Job Description Template for Retail | Charlie - Charming

Child Caregiver Job Description and Responsibilities for Caring for Children with Knowledge

IT Support Job Description: Software, Hardware, and Production Duties for Computer-related Support

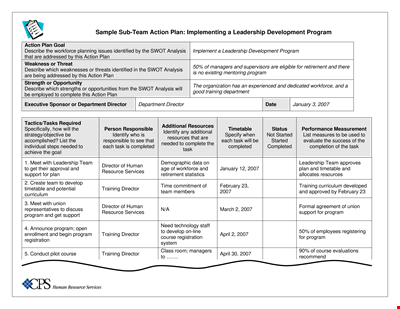

Sub Team Leader Action Plan Template

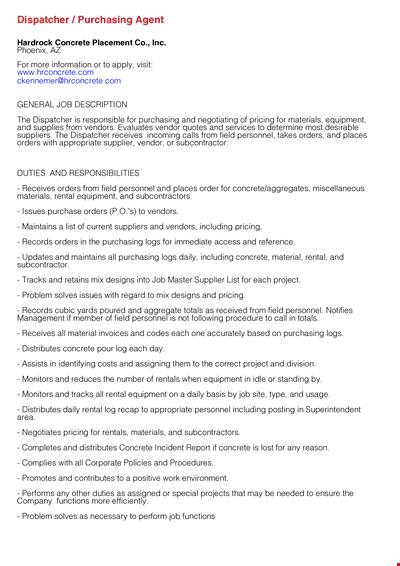

Dispatcher Purchasing Agent Job Description